An Arm and a Leg: John Green vs. Johnson & Johnson (Part 1)

Why is treating drug-resistant tuberculosis so expensive?

Pharmaceutical giant Johnson & Johnson’s patents on a drug called bedaquiline have a lot to do with it.

Why is treating drug-resistant tuberculosis so expensive?

Pharmaceutical giant Johnson & Johnson’s patents on a drug called bedaquiline have a lot to do with it.

In this episode of “An Arm and a Leg,” host Dan Weissmann speaks with writer and YouTube star John Green about how he mobilized his massive online community of “nerdfighters” to change the company’s policy and help make the drug more accessible.

But not every lifesaving drug has a champion with a platform as big as Green’s. Drug companies’ patents limit access to affordable treatments as well.

Weissmann also speaks with drug-patent expert Tahir Amin about how companies keep their drugs under patent for so long and the legal challenges that have been made to these policies around the world.

Dan Weissmann

Host and producer of "An Arm and a Leg." Previously, Dan was a staff reporter for Marketplace and Chicago's WBEZ. His work also appears on All Things Considered, Marketplace, the BBC, 99 Percent Invisible, and Reveal, from the Center for Investigative Reporting.

Credits

Emily Pisacreta

Producer

Adam Raymonda

Audio wizard

Ellen Weiss

Editor

Click to open the Transcript

Transcript: John Green vs. Johnson & Johnson (Part 1)

Note: “An Arm and a Leg” uses speech-recognition software to generate transcripts, which may contain errors. Please use the transcript as a tool but check the corresponding audio before quoting the podcast.

Dan: Hey there — A little while ago, I got to talk with this widely-beloved dude.

John Green: My name is John Green, and I’m a writer and YouTuber.

Dan: John Green, writer, may be the most likely to ring a bell. His best-known book, “The Fault in Our Stars,” sold millions of copies and became a movie.

But before he was such a big deal as a writer, he and his brother Hank were a big deal on YouTube. And they still are. We’ll get into the details a little bit later.

But for now the thing to know is: Pretty recently, John Green got on the main YouTube channel he and his brother share, and started talking to hundreds of thousands of people about how the drug-maker Johnson & Johnson was using legalistic drug patent games to deny access to life saving tuberculosis medicine to millions of people in poor countries. And John Green wanted anybody listening to stand up and do something about it.

John Green: Tell your friends about this injustice, tell your family, tell the internet, because the only reason Johnson Johnson executives think they can get away with this is that they think we aren’t paying attention in the part of the world where they sell most of their products, their Band Aids, their Tylenol, their Listerine.

Dan: And a lot of the people who watch John Green’s videos– the community calls themselves “nerdfighters” — made a fair amount of noise.

And a few days later, Johnson & Johnson seemed to blink. The company issued a statement saying it would allow a cheaper generic version of that TB drug to be more widely distributed. Here’s John’s brother Hank from their next YouTube video.

Hank Green: And this happened in a week, John, you made a video on Tuesday, “it’s Friday right now! I’m really proud to be a part of this community I’m really proud to be your brother…”

Dan: I mean, that’s a super-fun story that we’re gonna get into: How a self-proclaimed nerd raised an internet posse to influence a global pharma giant to do something pretty decent-sounding.

We are definitely going to tell that story.

… But that story is just a first impression, because the whole thing is bigger and way more complicated.

As John Green would tell you –as he told me – he was adding his bit to a global movement — to advocates and lawyers in places like India, for instance, that have been doing the heavy, heavy lifting, for years.

And, of course, to understand any of this, we are going to have to get into how pharma companies use drug patents. And what it means.

And that is part of where this story comes home.

As John Green mentioned in his video, the story of this tuberculosis drug wouldn’t normally draw a lot of attention in the U.S. TB isn’t one of our top health issues.

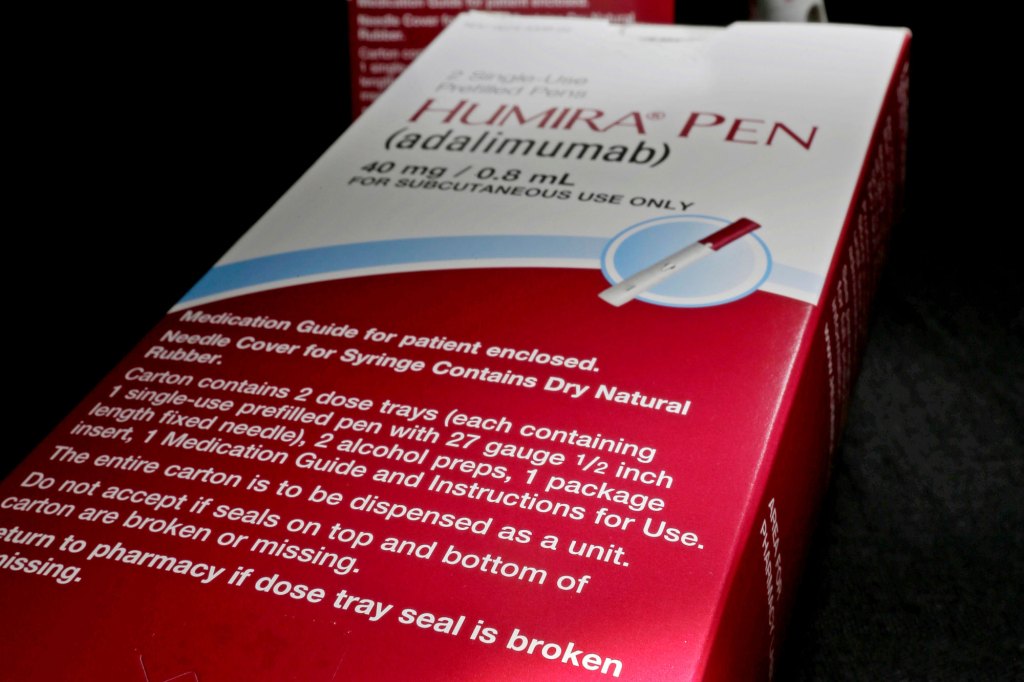

But … the mechanisms at play with this tuberculosis drug – the patent games – are some of the same mechanisms that make so many drugs here so expensive: Drugs like Humira, and insulin, and pretty much everything else.

And here’s what’s actually the most interesting part:

Behind the first impression version of this story – nerds in the U.S. and their online posse for people in what’s called the Global South –

There’s a story about people and ideas from the Global South coming here to save the U.S. from our own messed-up drug patent system.

Because they’ve figured out that unless we save ourselves, they’re screwed too. That’s a LOT! And it’s gonna take us two episodes to connect all the dots.

You ready? Here we go…

This is An Arm and a Leg. A show about why health care costs so freaking much, and what we can maybe do about it. I’m Dan Weissmann. I’m a reporter, and I like a challenge. So our job on this show is to take one of the most enraging, terrifying, depressing parts of American life, and to bring you something entertaining, empowering, and useful.

And so, let’s start with John Green — YouTuber.

John and his brother Hank were among the people who invented the idea of being a professional quote-unquote “creator” on the internet – maybe kind of by accident, at first. But they were hugely successful at it.

In 2007, they started posting video messages to each other on this still-kinda-new website called YouTube. They thought a few hundred people might be interested, if they kept it up for a year.

Then Hank posted a song about waiting for the last Harry Potter book to come out.

Hank Green: [Singing] … I’m getting kind of petrified. What would Ron do if Hermione died or if Voldemort killed Hedwig, Just for yucks? …

Dan: It got a million views– which, early YouTube? That was huge. And they were off. Today, that original YouTube channel has more than three and a half million subscribers. Hank now manages more than a hundred full-time employees and a whole bunch of contractors.

And, you know, it’s impossible to sum up the thousands of videos they’ve shared.

Hank Green: Good morning, John. Today we’re gonna be making cinnamon toast two different ways.

John Green: Good morning, Hank, it’s Tuesday. So I need your help with the thing I’m working on. I need to learn some jokes, but not just any jokes.

Dan: But it’s fair to say digressive, ranty arguments are kind of a staple.

John Green: Good morning Hank, it’s Tuesday. I kind of hate Batman.

Hank Green: Good morning, John, you pretty much got Batman entirely wrong.

John Green: Batman is just a rich guy with an affinity for bats who’s playing out his insane fantasy of single-handedly ridding Gotham of crime. How is that heroic?

Hank Green: Of course, I know that Your video on Tuesday wasn’t really about Batman, it was just using Batman as a tool to say something.

Dan: The arguing may have something to do with why they call their community nerd-fighters.

But the idea is more that this is a community of nerds fighting for something. As they put it: fighting to ‘reduce the amount of suck in the world.’

Partly by producing things that can be amusing and sweet and thoughtful – but also by giving money to worthy causes and encouraging others to do the same.

Every year, since the beginning, they have hosted a kind of online telethon called the Project for Awesome.

John Green: Good morning, Hank. It’s Thursday, December 17th, 2009. Time for the Project for Awesome! Hooray! Oh! [crashing sound] Ow! Whoa! I got too excited about the awesome.

Dan: It is SUPER-interactive: People upload videos pitching their favorite charities, they vote, they give. They’ve raised more than 30 million dollars. And a lot of it has gone to an organization called Partners in Health, which provides incredibly effective health services in places like Haiti and Sierra Leone.

And just to indulge my own tendency to nerdy digression here: A book about Partners in Health and its founder, Paul Farmer, is one of my favorite books of all time.

It’s called Mountains Beyond Mountains, and when we finally do start a book club – and I haven’t forgotten making that suggestion here – I want to nominate it as one of our first picks.

Anyway, the Green brothers are huge supporters of Partners in Health. And then, three years ago, John started one of his weekly videos this way.

John Green: Good morning, Hank, it’s Tuesday. So over the next five years, our families are donating six and a half million dollars to Partners in Health Sierra Leone. Also we need your help…

Dan: And here’s where we get to tuberculosis. In the run up to that commitment, John Green visited Sierra Leone with his wife Sarah, and met some of the folks there from Partners in Health.

Here’s how he told the story to me. I’m not gonna interrupt:

John Green: On the last day, two of the physicians from Partners in Health, who we were visiting with said, “Hey, if it’s not a big deal to you, we’d really like to stop by this TB hospital on the way back to the capitol because we have a case we’re really concerned about.” And I said, “Yeah, of course, I’m not going to get in the way of actual doctoring.” So … But I, you know, I didn’t think much of it at the time.

So we get to this TB hospital. And immediately upon arriving, the doctors go off to do doctor stuff. And Sarah and I are just sort of sitting there in this little nine year old boy who tells me his name is Henry, which is my son’s name, at the time, my son was nine, kind of grabs me by the shirt and starts walking me around. And he takes me to the lab, shows me how to look into the microscope to see if a specimen has tuberculosis, introduces me to the lab technician, he takes me to the patient wards, he takes me to the kitchen where they make the food, he takes me all over the hospital, and then eventually I end up in the room with where the doctors are, and, uh, and the, and the kid has departed and I said, you know, “I just spent 30 minutes with an extraordinary child named Henry and he gave me a tour of the whole facility and I have no idea who he is. Is he somebody’s kid? Is he a doctor’s kid?” And one of the doctors said, “you know, that’s what I thought when I first got here, uh, about Henry because he does seem like that. And actually he’s the case that we’re so concerned about that we, um, needed to come here.” And he wasn’t nine. He was 16. He was just really stunted and emaciated by tuberculosis.

And, um, even though he was feeling pretty good at the time, the doctors knew that his treatment for multidrug resistant TB was failing, and that he needed access to a new cocktail that included bedaquiline, this drug that’s been around in the U.S. since 2013, but was, was at the time totally unavailable in Sierra Leone. And so, that was my introduction to TB and we were on our way to the airport and I said, “what’s gonna, what’s gonna happen to that kid?” And they were like, “it’s going to be a difficult path for him um, if we can’t get, if we can’t get the new treatment cocktail to him, he has a very low chance of survival.”

So that’s the beginning of the story for me, is meeting Henry.

Dan: I’m going to skip to the end of this part of the story: Henry’s OK. He’s alive, because he did get the drug cocktail that included Bedaquiline.

But, after that visit, John Green did not know that, and he started obsessing a bit about tuberculosis. Reading about it, thinking about it. And over the last year or so, he started occasionally sharing, making videos about TB. Some of them were fun, short, nerdy explainers.

John Green: What if I told you that tuberculosis gave us the cowboy hat?

John Green: How did TB reinvigorate women’s shoe fashions?

John Green: How did tuberculosis help New Mexico become a state? I’m so glad you asked.

Dan: But he also dug into the deeper reason he’d become obsessed with TB. Because it’s a surprisingly big deal, still.

John Green: It’s almost certain that in the last 2, 000 years, more people died just from tuberculosis than died from all wars combined.

And before you think like, oh, but that’s ancient history. No, more people died last year from tuberculosis than died in war, and every year going back to World War II

Dan: We fact checked that. He’s actually understating things. By a lot.

TB is a growing problem. In the middle of the 20th Century, new medicines took TB off the list of diseases that most people in the rich parts of the world had to worry about. But it never got wiped out.

And in less-rich parts of the world, where access to the best treatments was spottier, drug-resistant strains of TB developed and developed. But no new drugs came out– no drugs for drug-resistant TB.

Until bedaquiline, produced by Johnson & Johnson. The drug that did eventually help save Henry, the kid that John Green met in Sierra Leone.

But bedaquiline is expensive. So people in less-rich parts of the world often can’t get it. One study estimated that eight out of nine people who needed treatment with a drug like bedaquiline weren’t getting it.

And of course medicines stay expensive when they’re under patent protection: Once the patent on a drug expires, anybody can make and sell a generic version of the drug. Which, you know, competition, usually allows prices to fall.

And in one way, as John Green started making tuberculosis videos in 2022, it might have seemed like there was hope coming up:

Bedaquiline was patented in 2003. Patents last twenty years. By 2023, that patent would expire.

Except, not really. Because it turns out, patents on drugs have ways of living for way more than twenty years.

That’s next.

MIDROLL: This episode of An Arm and a Leg is produced in partnership with KFF Health News. That’s a nonprofit newsroom that covers health care in America. KFF Health News are amazing journalists – their work wins all kinds of awards every year – and I’m honored to work with them. We’ll have a little more information about KFF at the end of this episode.

Dan: So, let’s talk about drug patents and how they work– and why they don’t just last 20 years. And this is something my colleague Emily Pisacreta has been interested in for a long time.

Emily: It’s true. As I’ve said before on the show, I’m an insulin-dependent diabetic. If I can’t get insulin, I’m literally dead. And, insulin is super expensive. And insulins have became so expensive in part because of the kinds of patents on them – even though those patents are way more than twenty years old! ..

Dan: Right, so you’ve got a big interest in this question: How can a patent last more than twenty years?

Emily: And Dan, my answer to that question is a riddle: When is a patent not a patent?

Dan: OK, I give up. When is a patent not a patent.

Emily: When it’s 74 patents.

Dan: Yeah, this riddle is going to need some explaining.

Emily: Right. So, for a while I used an insulin called Lantus.It’s a once-a-day, long acting insulin made by the French company Sanofi. Sanofi first patented Lantus in 1994. So, that should mean it’s out of patent protection by 2014, right?

Dan: Uh-huh

Emily: Except, according to a report from a few years back, Sanofi actually filed for 74 patents on Lantus. And a lot of those patents were filed WAY after 1994. So, ONE patent from 1994 would’ve lasted till 2014. 74 patents could’ve lasted until 2031.

Dan: Ah, hence the very-specific answer for your riddle. I mean, I knew the principle – these insulin products have multiple patents on them, but 74 is … more than I’d imagined. What are 74 things you even COULD patent?

Emily: I mean, for Lantus, there are patents on formulations to improve stability. Like, all right … But there are also patents on the pen cartridge that Lantus comes in. And inside of that, a whole bunch of patents on the drive mechanisms, like the little plastic piston that lets you pick the right dose. These kinds of things.

Dan: OK. Now, I notice you said, those 74 patents COULD’ve lasted until 2031?

Emily: That’s right. As it turns out, in the case of Lantus, another drug maker actually did fight some of Sanofi’s later patents and won. But more often – and I mean a lot more often — simply filing for a patent is enough to keep generic makers away.

Dan: Sure. Who wants to spend money fighting a patent lawsuit when you could just y’know, manufacture some other drug?

Emily: Right. And of course this is not just insulin.

Tahir Amin: Oh, this is the standard practice. This happens with every drug.

Emily: That’s Tahir Amin – one of the big global experts on drug patents. Tahir the CEO and cofounder of a non-profit called I-MAK, which stands for …

Tahir Amin: The Initiative for Medicines Access and Knowledge. We work on building a more just and equitable access to medicine system.

Emily: The report that documented 74 patents on Lantus, that one insulinI used to use? Tahir’s group wrote it. And Tahir says this is business as usual, because it means big money.

Tahir Amin: Particularly when you’re talking about some of the drugs that you see in the US market, like for rheumatoid arthritis, these are worth billions of dollars.

Emily: Tahir’s group did a study on the 12 best-selling drugs in the U.S. They had an average of 131 patents each. If all the patents stick, that’s an average of 38 years of patent protection.

Dan: So maybe we can update your riddle:

When is a patent not a patent?

When it’s 131 patents.

Emily: Yeah, activists and experts call this kind of thing “patent thicketing” or “evergreening.”

Dan: I’ve been reading up on this too. Drug companies have their own name for this practice. They call it “life-cycle management.”

Emily: What a term of art. And actually bedaquiline, the TB drug,is a great example. In 2014, Tahir did what they call a “patent landscape” on bedaquiline, mapping all the different patents J&J filed around the world.

Tahir Amin: We all knew that with the advent of multiple drug resistance TB, we needed to know how we’re gonna get these drugs to the communities and the countries that need them most.

Emily: He identified a long list of patents J&J filed. And the most important being the original formula for the drug, set to expire in 2023, and the second most important patent was on something called the salt formulation for the drug.

Dan: Salt formulation.

Emily: Yep, and it’s kind of worth getting into the weeds here just for a second. Because this sort of thing is at the absolute heart of these drug patent games. When you develop a drug, the first step is finding a molecule that works in a test tube, that does the thing you want, like kills the germ. That gonna be the first patent, that molecule. But the molecule isn’t medicine.

Tahir Amin: You have to develop it, formulate it so that it’s actually more bioavailable, that it can get into the bloodstream and, and do whatever biological activity that it does. And this is classic organic chemistry stuff that is routine.

Emily: It’s routine. SO what he’s saying here, and other experts agree, by the way, identifying a salt formulation that can work as medicine isn’t where the innovation is. And most importantly, it doesn’t have to take a long time. But J&J didn’t apply for their secondary patent on it until a full four years after their initial patent.

Dan: I’ve started reading about “lifecycle management,” you know, what the pharma industry calls all this. And this is literally the playbook. One lawyer has advice about when to file this kind of secondary patent, here’s what he says, quote:

“You want to do this as late as possible, but before clinical trials. If Company X can hold off filing for two or three years during the drug discovery phase, it will buy more time on the back end of the patent’s term.”

Emily: Yep, and J & J waited four years. A little extra.

Dan: And we asked Johnson & Johnson: Hey, did you put off filing this secondary patent on the salt formulation to stretch out your patent rights? We haven’t heard back.

So: TB advocates kind of had their eye on July 2023. Because in July 2023 the original patent that Johnson & Johnson had on bedaquiline was set to expire. And the secondary patent, this sort of basic add on, was to become the next big obstacle.

So, back to John Green. He’s learning all this stuff about TB – including about how the secondary patent on bedaquiline is gonna keep clamping down access.

And he’s making all these TB videos, but it’s not like he has some kind of big plan:

John Green: But the, for me, You know, this is all I was thinking about. It was the first thing I thought about in the morning and the last thing I thought about before I went to sleep, is how did we end up in a world where the world’s deadliest infectious disease is largely ignored in the richest parts of the world?

Dan: And he was getting kind of discouraged.

John Green: I felt powerless before it. And this is one of the real lessons for me is that I felt like, well, what … what are we going to do? It’s not like Johnson & Johnson is going to abandon the idea of secondary patents, right?

Dan: He knew: secondary patents can be worth billions of dollars.

John Green: And so they’re not going to abandon these attempts to make their patents last longer than they should because they’re a for profit company. And I felt really … Yeah, I just felt powerless.

Dan: And then, earlier this year, something changed. It was not something that John Green, or an army of nerds could have done, or could’ve done anything about.

It was done by India’s patent office – responding to a legal challenge brought by two young women who had survived tuberculosis – one from India and one from South Africa.

It was based on legal work that our new pal Tahir Amin and others did in India almost twenty years ago.

And gave John Green an idea of how an army of nerdfighters could join this battle.

That’s next time, on An Arm and a Leg. Till then, take care of yourself.

This episode of An Arm and a Leg was produced by me, Dan Weissmann, and Emily Pisacreta – with help from Bella Cjazkowski, and edited by Ellen Weiss.

Daisy Rosario is our consulting managing producer.

Adam Raymonda is our audio wizard.

Our music is by Dave Winer and Blue Dot Sessions.

Gabrielle Healy is our managing editor for audience. She edits the First Aid Kit Newsletter.

Bea Bosco is our consulting director of operations.

Sarah Ballema is our operations manager.

An Arm and a Leg is produced in partnership with KFF Health News–formerly known as Kaiser Health News. That’s a national newsroom producing in-depth journalism about health care in America, and a core program at KFF — an independent source of health policy research, polling, and journalism.

And yes, you did hear the name Kaiser in there, and no: KFF isn’t affiliated with the health care giant Kaiser Permanente. You can learn more about KFF Health News at armandalegshow.com/KFF.

Zach Dyer is senior audio producer at KFF Health News. He is editorial liaison to this show.

Thanks to Public Narrative — that’s a Chicago-based group that helps journalists and nonprofits tell better stories — for serving as our fiscal sponsor, allowing us to accept tax-exempt donations. You can learn more about Public Narrative at www.publicnarrative.org.

And thanks to everybody who supports this show financially.

If you haven’t yet, we’d love for you to join us. The place for that is armandalegshow.com/support. That’s armandalegshow.com/support.

It helps us out a lot, so thanks for pitching in if you can! And thanks for listening!

“An Arm and a Leg” is a co-production of KFF Health News and Public Road Productions.

To keep in touch with “An Arm and a Leg,” subscribe to the newsletter. You can also follow the show on Facebook and Twitter. And if you’ve got stories to tell about the health care system, the producers would love to hear from you.

To hear all KFF Health News podcasts, click here.

And subscribe to “An Arm and a Leg” on Spotify, Apple Podcasts,Pocket Casts, or wherever you listen to podcasts.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

1 year 8 months ago

Health Care Costs, Multimedia, Pharmaceuticals, Public Health, An Arm and a Leg, Drug Costs, Podcasts

KFF Health News' 'What the Health?': More Medicaid Messiness

The Host

Julie Rovner

KFF Health News

Julie Rovner is chief Washington correspondent and host of KFF Health News’ weekly health policy news podcast, “What the Health?” A noted expert on health policy issues, Julie is the author of the critically praised reference book “Health Care Politics and Policy A to Z,” now in its third edition.

Federal officials have instructed at least 30 states to reinstate Medicaid and Children’s Health Insurance Program coverage for half a million people, including children, after an errant computer program wrongly determined they were no longer eligible. It’s just the latest hiccup in the yearlong effort to redetermine the eligibility of beneficiaries now that the program’s pandemic-era expansion has expired.

Meanwhile, the federal government is on the verge of a shutdown, as a small band of House Republicans resists even a short-term spending measure to keep the lights on starting Oct. 1. Most of the largest federal health programs, including Medicare, have other sources of funding and would not be dramatically impacted — at least at first. But nearly half of all employees at the Department of Health and Human Services would be furloughed, compromising how just about everything runs there.

This week’s panelists are Julie Rovner of KFF Health News, Rachel Roubein of The Washington Post, Sandhya Raman of CQ Roll Call, and Sarah Karlin-Smith of Pink Sheet.

Panelists

Sarah Karlin-Smith

Pink Sheet

Sandhya Raman

CQ Roll Call

Rachel Roubein

The Washington Post

Among the takeaways from this week’s episode:

- Officials in North Carolina announced the state will expand its Medicaid program starting on Dec. 1, granting thousands of low-income residents access to health coverage. With North Carolina’s change, just 10 states remain that have not expanded the program — yet, considering those states have resisted even as the federal government has offered pandemic-era and other incentives, it is unlikely more will follow for the foreseeable future.

- The federal government revealed that nearly half a million individuals — including children — in at least 30 states were wrongly stripped of their health coverage under the Medicaid unwinding. The announcement emphasizes the tight-lipped approach state and federal officials have taken to discussing the in-progress effort, though some Democrats in Congress have not been so hesitant to criticize.

- The White House is pointing to the possible effects of a government shutdown on health programs, including problems enrolling new patients in clinical trials at the National Institutes of Health and conducting food safety inspections at the FDA.

- Americans are grappling with an uptick in covid cases, as the Biden administration announced a new round of free test kits available by mail. But trouble accessing the updated vaccine and questions about masking are illuminating the challenges of responding in the absence of a more organized government effort.

- And the Biden administration is angling to address health costs at the executive level. The White House took its first step last week toward banning medical debt from credit scores, as the Federal Trade Commission filed a lawsuit to target private equity’s involvement in health care.

- Plus, the White House announced the creation of its first Office of Gun Violence Prevention, headed by Vice President Kamala Harris.

Also this week, Rovner interviews KFF Health News’ Samantha Liss, who reported and wrote the latest KFF Health News-NPR “Bill of the Month,” about a hospital bill that followed a deceased patient’s family for more than a year. If you have an outrageous or infuriating medical bill you’d like to send us, you can do that here.

Plus, for “extra credit,” the panelists suggest health policy stories they read this week they think you should read, too:

Julie Rovner: JAMA Internal Medicine’s “Comparison of Hospital Online Price and Telephone Price for Shoppable Services,” by Merina Thomas, James Flaherty, Jiefei Wang, et al.

Sarah Karlin-Smith: The Los Angeles Times’ “California Workers Who Cut Countertops Are Dying of an Incurable Disease,” by Emily Alpert Reyes and Cindy Carcamo.

Rachel Roubein: KFF Health News’ “A Decades-Long Drop in Teen Births Is Slowing, and Advocates Worry a Reversal Is Coming,” by Catherine Sweeney.

Sandhya Raman: NPR’s “1 in 4 Inmate Deaths Happen in the Same Federal Prison. Why?” by Meg Anderson.

Also mentioned in this week’s episode:

- KFF Health News’ “Diagnosis: Debt,” by Noam N. Levey and KFF Health News, NPR, and CBS staff.

- The New York Times’ “In Hospitals, Viruses Are Everywhere. Masks Are Not,” by Apoorva Mandavilli.

click to open the transcript

Transcript: More Medicaid Messiness

KFF Health News’ ‘What the Health?’Episode Title: More Medicaid MessinessEpisode Number: 316Published: Sept. 27, 2023

[Editor’s note: This transcript was generated using both transcription software and a human’s light touch. It has been edited for style and clarity.]

Julie Rovner: Hello and welcome back to “What the Health?” I’m Julie Rovner, chief Washington correspondent for KFF Health News. And I’m joined by some of the best and smartest health reporters in Washington. We’re taping early this week, on Wednesday, Sept. 27, at 10 a.m. As always, news happens fast and things might’ve changed by the time you hear this, so here we go.

We are joined today via video conference by Rachel Roubein of The Washington Post.

Rachel Roubein: Good morning. Thanks for having me.

Rovner: Sandhya Raman of CQ Roll Call.

Sandhya Raman: Good morning.

Rovner: And Sarah Karlin-Smith of the Pink Sheet.

Sarah Karlin-Smith: Hi, everybody.

Rovner: Later in this episode we’ll have my KFF Health News-NPR “Bill of the Month” interview with Samantha Liss. This month’s bill is literally one that followed a patient to his family after his death. But first, the news. I want to start with Medicaid this week. North Carolina, which approved but didn’t fund its Medicaid expansion earlier this year, approved a budget this week that will launch the expansion starting Dec. 1. That leaves just 10 states that have still not expanded the program to, mostly, low-income adults, since the Affordable Care Act made it possible in, checks notes, 2014. Any other holdout states on the horizon? Florida is a possibility, right, Rachel?

Roubein: Yes. There’s only technically three states that can do ballot measures. Now North Carolina, I believe, was the first state to actually pass through the legislature since Virginia in 2018. A lot of the most recent states, seven conservative-leaning states, instead pursued the ballot measure path. In Florida, advocates have been eyeing a 2026 ballot measure. But the one issue in Florida is that they need a 60% threshold to pass any constitutional amendment, so that is pretty, pretty high and would take a lot of voter support.

Rovner: And they would need a constitutional amendment to expand Medicaid?

Roubein: A lot of the states have been going the constitutional amendment route in terms of Medicaid in recent years. Because what they found was some legislatures would come back and try and change it, but if it’s a constitutional amendment, they weren’t able to do that. But a lot of the holdout states don’t have ballot measure processes, where they could do this — like Alabama, Georgia, etc.

Raman: Kind of just echoing Rachel that this one has been interesting just because it had come through the legislature. And even with North Carolina, it’s been something that we’ve been eyeing for a few years, and that they’d gone a little bit of the way, a little bit of the way a few times. And it was kind of the kind of gettable one within the ones that hadn’t expanded. And the ones we have left, there’s just really not been much progress at all.

Rovner: I would say North Carolina, like Virginia, had a Democratic governor that ran on this and a Republican legislature, or a largely Republican legislature, hence the continuing standoff. It took both states a long time to get to where they had been trying to go. And you’re saying the rest of the states are not split like that?

Raman: Yeah, I think it’ll be a much more difficult hill to climb, especially when, in the past, we had more incentives to expand with some of the previous covid relief laws, and they still didn’t bite. So it’s going to be more difficult to get those.

Rovner: No one’s holding their breath for Texas to expand. Anyway, while North Carolina will soon start adding people to its Medicaid rolls, the rest of the states are shedding enrollees who gained coverage during the pandemic but may no longer be eligible. And that unwinding has been bumpy to say the least. The latest bump came last week when the Department of Health and Human Services revealed that more than half a million people, mostly children, had their coverage wrongly terminated by as many as 30 states. It seems a computer program failed to note that even if a parent’s income was now too high to qualify, that same income could still leave their children eligible. Yet the entire family was being kicked off because of the way the structure of the program worked. I think the big question here is not that this happened, but that it wasn’t noticed sooner. It should have been obvious — children’s eligibility for Medicaid has been higher than adults since at least the 1980s. This unwinding has been going on since this spring. How is this only being discovered now? It’s September. It’s the end of September.

Roubein: Yeah. I mean, this was something advocates who have been closely watching this have been ringing the alarm bells for a while, and then it took time. CMS [the Centers for Medicare & Medicaid Services] had put something out, I believe it was roughly two weeks before they actually then had the roughly half a million children regain coverage — they had put out a, “OK, well, we’re exploring which states.” And lots of reporters were like, “OK, well which state is this an issue?” So yeah, the process seemed like it took some time here.

Rovner: I know CMS has been super careful. I mean, I think they’re trying not to politicize this, because they’ve been very careful not to name states, and in many cases who they know have been wrongly dropping people. I guess they’re trying to keep it as apolitical as possible, but I think there are now some advocates who worry that maybe CMS is being a little too cautious.

Karlin-Smith: Yeah, I think from the other side too, if you’ve talked to state officials, they’re also trying to be really cautious and not criticize CMS. So it seems like both sides are not wanting to go there. But I mean some Democrats in Congress have been critical of how the effort has gone.

Rovner: Yeah. And of course, if the government shuts down, as seems likely at the end of this week, that’s not going to make this whole process any easier, right? The states will still get to do what the states are doing. Their shutdown efforts, or their re-qualification efforts, are not federally funded, but the people at CMS are.

Karlin-Smith: Yeah, that’ll just throw another thorn in this as we’re getting very, very likely headed towards a shutdown at this point on the 27th. So I think that’ll be another barrier for them regardless. And I mean, most CMS money isn’t even affected by the yearly budget anyways because it’s mandatory funding, but that’ll be a barrier for sure.

Rovner: So, speaking of the government shutdown, it still seems more likely than not that Congress will fail to pass either any of the 12 regular spending bills or a temporary measure to keep the lights on when the fiscal year ends at midnight Sunday. That would lead to the biggest federal shutdown since 2013 when, fun fact, the shutdown was an attempt to delay the rollout of the Affordable Care Act. What happens to health programs if the government closes? It’s kind of a big confusing mess, isn’t it?

Roubein: Yeah, well, what we know that would definitely continue and in the short term is Medicare and Medicaid, Obamacare’s federal insurance marketplace. Medicaid has funding for at least the next three months, and there’s research developing vaccines and therapeutics that HHS, they put out their kind of contingency “What happens if there’s a shutdown?” plan. But there’s some things that the White House and others are kind of trying to point to that would be impacted, like the National Institutes of Health may not be able to enroll new patients in clinical trials, the FDA may need to delay some food safety inspections, etc.

Rovner: Sarah, I actually forgot because, also fun fact, the FDA is not funded through the rest of the spending bill that includes the Department of Health and Human Services. It’s funded through the agriculture bill. So even though HHS wasn’t part of the last shutdown in 2018 and 2019, because the HHS funding bill had already gone through, the FDA was sort of involved, right?

Karlin-Smith: Right. So FDA is lumped with the USDA, the Agriculture Department, for the purposes of congressional funding, which is always fun for a health reporter who has to follow both of those bills. But FDA is always kind of a unique one with shutdown, because so much of their funding now is user fees, particularly for specific sections. So the tobacco part of FDA is almost 100% funded by user fees, so they’re not really impacted by a shutdown. Similarly, a lot of drug, medical device applications, and so forth also are totally funded by user fees, so their reviews keep going. That said, the way user fees are, they’re really designated to specific activities.

So, where there isn’t user fees and it’s not considered a critical kind of public health threat, things do shut down, like Rachel mentioned: a lot of food work and inspections, and even on the drug and medical device side, some activities that are related that you might think would continue don’t get funded.

Rovner: Sandhya, is there any possibility that this won’t happen? And that if it does happen, that it will get resolved anytime soon?

Raman: At this point, I don’t think that we can navigate it. So last night, the Senate put out their bipartisan proposal for a continuing resolution that you would attach as an amendment to the FAA, the Federal Aviation [Administration] reauthorization. And so that would temporarily extend a lot of the health programs through Nov. 17. The issue is that it’s not something that if they are able to pass that this week, they’d still have to go to the House. And the House has been pretty adamant that they want their own plan and that the CR that they were interested in had a lot more immigration measures, and things there.

And the House right now has been busy attempting to pass this week four of the 12 appropriations bills. And even if they finished the four that they did, that they have on their plate, that would still mean going to the Senate. And Biden has said he would veto those, and it’s still not the 12. So at this point, it is almost impossible for us to not at least see something short-term. But whether or not that’s long-term is I think a question mark in all the folks that I have been talking to about this right now.

Rovner: Yeah, we will know soon enough what’s going to happen. Well, meanwhile, because there’s not enough already going on, covid is back. Well, that depends how you define back. But there’s a lot more covid going around than there was, enough so that the federal government has announced a new round of free tests by mail. And there’s an updated covid vaccine — I think we’re not supposed to call it a booster — but its rollout has been bumpy. And this time it’s not the government’s fault. That’s because this year the vaccine is being distributed and paid for by mostly private insurance. And while lots of people probably won’t bother to get vaccinated this fall, the people who do want the vaccine are having trouble getting it. What’s happening? And how were insurers and providers not ready for this? We’d been hearing the updated vaccines would be available in mid-September for months, Sarah. I mean they really literally weren’t ready.

Karlin-Smith: Yeah. I mean, it’s not really clear why they weren’t ready, other than perhaps they felt they didn’t need to be, to some degree. I mean, normally, I know I was reading actually because we’ve also recently gotten RSV [respiratory syncytial virus] vaccine approvals — normally they actually have almost like a year, I think, to kind of add vaccines to plans and schedules and so forth, and pandemic covid-related laws really shortened the time for covid. So they should have been prepared and ready. They knew this was coming. And people are going to pharmacies, or going to a doctor’s appointment, and they’re being told, “Well, we can give you the vaccine, but your insurance plan isn’t set up to cover it yet, even though technically you should be.” There seems like there’s also been lots of distribution issues where again, people are going to sites where they booked appointments, and they’re saying, “Oh, actually we ran out.” They’re trying another site. They’ve run out.

So, it’s sort of giving people a sense of the difference of what happens when sort of the government shepherds an effort and everybody — things are a bit simplified, because you don’t have to think about which site does your insurance cover. There is a program for people who don’t have insurance now who can get the vaccine for free, but again, you’re more limited in where you can go. There’s not these big free clinics; that’s really impacting childhood vaccinations, because, again, a lot of children can’t get vaccinated at the pharmacy. So I think people are being reminded of what normal looked like pre-covid, and they’re realizing maybe we didn’t like this so much after all.

Rovner: Yeah, it’s not so efficient either. All the people who said, “Oh, the private sector could do this so much more efficiently than the government.” And it’s like, we’re ending up with pretty much the same issues, which is the people who really want the vaccine are chasing around and not finding it. And I know HHS Secretary Becerra went and had this event at a D.C. pharmacy where he was going to get his vaccine. And I think the event was intended to encourage people to go get vaccinated, but it happened right at the time when the big front surge of people who wanted to get vaccinated couldn’t find the vaccine.

Karlin-Smith: I think that’s a big concern because we’ve had such low uptake of booster or additional covid shots over the past couple of years. So the people who are sort of the most go-getters, the ones who really want the shots, are having trouble and feeling a bit defeated. What does that mean for the people that are less motivated to get it, who may not make a second or third attempt if it’s not easy? We sort of know, and I think public health folks kind of beat the drum, that sort of just meeting people where they are, making it easy, easy, easy, is really how you get these things done. So it’s hard to see how we can improve uptake this year when it’s become more complicated, which I think is going to be a big problem moving forward.

Rovner: Yeah. Right. And clearly these are issues that will be ironed out probably in the next couple of weeks. But I think what people are going to remember, who are less motivated to go get their vaccines, is, “Oh my God, these people I know tried to get it and it took them weeks. And they showed up for their appointment and they couldn’t get it.” And it’s like, “It was just too much trouble and I can’t deal with it.” And there’s also, I think you mentioned that there’s an issue with kids who are too young to get the vaccine too, right?

Karlin-Smith: Right. Still, I think people forget that you have to be 6 months to get the vaccine. If you’re under 3, you basically cannot get it in a pharmacy, so you have to get it in a doctor’s office. But a lot of people are reporting online their doctor’s office sort of stopped providing covid vaccines. So they’re having trouble just finding where to go. It seems like the distribution of shots for younger children has also been a bit slower as well. And again, this is a population where just even primary series uptake has been a problem. And people are in this weird gap now where, if you can’t get access to the new covid vaccine but your kid is eligible, the old vaccine isn’t available.

So you’re sort of in this gap where your kid might not have had any opportunity yet to get a covid vaccine, and there’s nothing for them. I think we forget sometimes that there are lots of groups of people that are still very vulnerable to this virus — including newborn babies who haven’t been exposed at all, and haven’t gotten a chance to get vaccinated.

Rovner: Yeah. So this is obviously still something that we need to continue to look at. Well, meanwhile, mask mandates are making a comeback, albeit a very small one. And they are not going over well. I’ve personally been wearing a mask lately because I’m traveling later this week and next, and don’t want to get sick, at least not in advance. But masks are, if anything, even more controversial and political than they were during the height of the pandemic. Does public health have any ideas that could help reverse that trend? Or are there any other things we could do? I’ve seen some plaintiff complaints that we’ve not done enough about ventilation. That could be something where it could help, even if people won’t or don’t want to wear masks. I mean, I’m surprised that vaccination is still pretty much our only defense.

Karlin-Smith: I think with masks, one thing that’s made it hard for different parts of the health system and lower-level kind of state public health departments to deal with masks is that the CDC [Centers for Disease Control and Prevention] recommendations around masking are pretty loose at this point. So The New York Times had a good article about hospitals and masking, and the kind of guidance around triggers they’ve given them are so vague. They kind of are left to make their own decisions. The CDC actually still really hasn’t emphasized the value of KN95 and N95 respirators over surgical masks. So I think it becomes really hard for those lower-level institutions to sort of push for something that is kind of controversial politically. And a lot of people are just tired of it when they don’t have the support of those bigger institutions saying it. And some of just even figuring out levels of the virus and when that should trigger masking.

It’s much harder to track nowadays because so much of our systems and data reporting is off. So, we have this sense we’re in somewhat of a surge now. Hospitalizations are up and so forth. But again, it’s a lot easier for people to make these decisions and figure out when to pull triggers when you have clear data that says, “This is what’s going on now.” And to some extent we’re … again, there’s a lot of evidence that points to a lot of covid going around now, but we don’t have that sort of hard data that makes it a lot easier for people to justify policy choices.

Raman: You just brought up ventilation and it took time, one, for some scientists to realize that covid is also spread through ultra-tiny particles. But it also took, after that, a while for the White House to pivot its strategy to stress ventilation measures in addition to masks, and face covering. So a lot of places are still kind of behind on having better ventilation in an office, or kind of wherever you’re going.

Rovner: Yeah, I mean, one would think that improving ventilation in schools would improve, not only not spreading covid, but not spreading all of the respiratory viruses that keep kids out of school and that make everybody sick during the winter, during the school year.

Roubein: I was going to piggyback on something Sarah said, which was about how the CDC doesn’t have clear benchmarks on when there should be a guideline for what is high transmission in the hospital for them to reinstate a mask mandate or whatever. But there’s also nuance to consider there. Within that there’s, is there a partial masking rule? Which is like: Does the health care staff have to wear them versus the patients? And does that have enough benefit on its own if it’s only required to one versus the other? I mean, I know that a lot of folks have called for more strict rules with that, but then there’s also the folks that are worried about the backlashes. This has gotten so politicized, how many different medical providers have talked about angst at them, attacks at them, over the polarization of covid? So there’s so many things that are intertwined there that it’s tough to institute something.

Karlin-Smith: I think the other thing is we keep forgetting this is not all about covid. We’ve learned a lot of lessons about public health that could be applicable, like you mentioned in schools, beyond covid. So if you’re in the emergency room, because you have cancer and you need to see a doctor right away. And you’re sitting next to somebody with RSV or the flu, it would also be beneficial to have that patient wearing a mask because if you have cancer, you do not need to add one of these infectious diseases on top of it. So it’s just been interesting, I think, for me to watch because it seemed like at different points in this crisis, we were sort of learning things beyond covid for how it could improve our health care system and public health. But for the most part, it seems like we’ve just kind of gone back to the old ways without really thinking about what we could incorporate from this crisis that would be beneficial in the future.

Rovner: I feel like we’ve lost the “public” in public health. That everybody is sort of, it’s every individual for him or herself and the heck with everybody else. Which is exactly the opposite of how public health is supposed to work. But perhaps we will bounce back. Well, moving on. The Biden administration, via the Consumer Financial Protection Bureau, the CFPB, took the first steps last week to ban medical debt from credit scores, which would be a huge step for potentially tens of millions of Americans whose credit scores are currently affected by medical debt. Last year, the three major credit bureaus, Equifax, Experian, and TransUnion, agreed not to include medical debt that had been paid off, or was under $500 on their credit reports. But that still leaves lots and lots of people with depressed scores that make it more expensive for them to buy houses, or rent an apartment, or even in some cases to get a job. This is a really big deal if medical debt is going to be removed from people’s credit reports, isn’t it?

Roubein: Yeah. I think that was an interesting move when they announced that this week. Because the CFPB had mentioned that in a report they did last year, 20% of Americans have said that they had medical debt. And it doesn’t necessarily appear on all credit reports, but like you said, it can. And having that financial stress while going through a health crisis, or someone in your family going through a health crisis, is layers upon layers of difficulty. And they had also said in their report that medical billing data is not an accurate indicator of whether or not you’ll repay that debt compared to other types of credit. And it also has the layers of insurance disputes, and medical billing errors, and all that sort of thing. So this proposal that they have ends up being finalized as a rule, it could be a big deal. Because some states have been trying to do this on a state-by-state level, but still in pretty early stages in terms of a lot of states being on board. So this can be a big thing for a fifth of people.

Rovner: Yeah, many people. I’m going to give a shout-out here to my KFF Health News colleague Noam Levey, who’s done an amazing project on all of this, and I think helped sort of push this along. Well, while we are on the subject of the Biden administration and money in health care, the Federal Trade Commission is suing a private equity-backed doctors group, U.S. Anesthesia Partners, charging anti-competitive behavior, that it’s driving up the price of anesthesia services by consolidating all the big anesthesiology practices in Texas, among other things. FTC Chair Lina Khan said the agency “will continue to scrutinize and challenge serial acquisitions roll-ups and other stealth consolidation schemes that unlawfully undermine fair competition and harm the American public.” This case is also significant because the FTC is suing not just the anesthesia company, but the private equity firm that backs it, Welsh, Carson, Anderson & Stowe, which is one of the big private equity firms in health care. Is this the shot across the bow for private equity and health care that a lot of people have been waiting for? I mean, we’ve been talking about private equity and health care for three or four years now.

Karlin-Smith: I think that’s what the FTC is hoping for. They’re saying not just that we’re going after anti-competitive practices in health care, that, I think, they’re making a clear statement that they’re going after this particular type of funder, which we’ve seen has proliferated around the system. And I think this week there was a report from the government showing that CMS can’t even track all of the private equity ownership of nursing homes. So we know this isn’t the only place where doctors’ practices being bought up by private equity has been seen as potentially problematic. So this has been a very sort of activist, I think, aggressive FTC in health care in general, and in a number of different sectors. So I think they’re ready to deliberate, with their actions and warnings.

Rovner: Yeah, it’s interesting. I mean, we mostly think, those of us who have followed the FTC in healthcare, which gets pretty nerdy right there, usually think of big hospital groups trying to consolidate, or insurers trying to consolidate these huge mega-mergers. But what’s been happening a lot is these private equity companies have come in and bought up physician practices. And therefore they become the only providers of anesthesia, or the only providers of emergency care, or the only providers of kidney dialysis, or the only providers of nursing homes, and therefore they can set the prices. And those are not the level of deals that tend to come before the FTC. So I feel like this is the FTC saying, “See you little people that are doing big things, we’re coming for you too.” Do we think this might dampen private equity’s enthusiasm? Or is this just going to be a long-drawn-out struggle?

Roubein: I could see it being more of a long-drawn-out struggle because even if they’re showing it as an example, there’s just so many ways that this has been done in so many kind of sectors as you’ve seen. So I think it remains to be seen further down the line as this might happen in a few different ways to a few different folks, and how that kind of plays out there. But it might take some time to get to that stage.

Karlin-Smith: I was going to say it’s always worth also thinking about just the size and budget of the FTC in comparison to the amount of private actors like this throughout the health system. So I mean, I think that’s one reason sometimes why they do try and kind of use that grandstanding symbolic messaging, because they can’t go after every bad actor through that formal process. So they have to do the signaling in different ways.

Raman: I think probably as we’ve all learned as health reporters, it takes a really long time for there to be change in the health care system.

Rovner: And I was just going to say, one thing we know about people who are in health care to make money is that they are very creative in finding ways to do it. So whatever the rules are, they’re going to find ways around them and we will just sort of keep playing this cat and mouse for a while. All right, well finally this week, a story that probably should have gotten more attention. The White House last week announced creation of the first-ever Office of Gun Violence Prevention to be headed by Vice President Kamala Harris. Its role will be to help implement the very limited gun regulation passed by Congress in 2022, and to coordinate other administration efforts to curb gun violence. I know that this is mostly for show, but sometimes don’t you really have to elevate an issue like this to get people to pay attention, to point out that maybe you’re trying to do something? Talk about things that have been hard for the government to do over the last couple of decades.

Raman: It took Congress a long time to then pass a new gun package, which the shooting in Uvalde last year ended up catalyzing. And Congress actually got something done, which was more limited than some gun safety advocates wanted. But it does take a lot to get gun safety reform across the finish line.

Rovner: I know. I mean, it’s one of those issues that the public really, really seems to care about, and that the government really, really, really has trouble doing. I’ve been covering this so long, I remember when they first banned gun violence research at HHS back in the mid-1990s. That’s how far back I go, that they were actually doing it. And the gun lobby said, “No, no, no, no, no. We don’t really want these studies that say that if you have a gun in the house, it’s more likely to injure somebody, and not necessarily the bad guy.” They were very unhappy, and it took until three or four years ago for that to be allowed to be funded. So maybe the idea that they’re elevating this somewhat, to at least wave to the public and say, “We’re trying. We’re fighting hard. We’re not getting very far, but we’re definitely trying.” So I guess we will see how that comes out.

All right, well that is this week’s news. Now, we will play my “Bill of the Month” interview with Sam Liss, and then we’ll come back with our extra credits. I am pleased to welcome to the podcast my KFF Health News colleague Samantha Liss, who reported and wrote the latest KFF Health News-NPR “Bill of the Month” installment. Welcome.

Liss: Hi.

Rovner: This month’s bill involves a patient who died in the hospital, right? Tell them who he was, what he was sick with, and about his family.

Liss: Yeah. So Kent Reynolds died after a lengthy hospital stay in February of 2022. He was actually discharged after complications from colon cancer, and died in his home. And his widow, Eloise Reynolds, was left with a series of complicated hospital bills, and she reached out to us seeking help after she couldn’t figure them out. And her and Kent were married for just shy of 34 years. They lived outside of St. Louis and they have two adult kids.

Rovner: So Eloise Reynolds received what she assumed was the final hospital bill after her husband died, which she paid, right?

Liss: Yeah, she did. She paid what she thought was the final bill for $823, but a year later she received another bill for $1,100. And she was confused as to why she owed it. And no one could really give her a sufficient answer when she reached out to the hospital system, or the insurance company.

Rovner: Can a hospital even send you a bill a year after you’ve already paid them?

Liss: You know what, after looking into this, we learned that yeah, they actually can. There’s not much in the way that stops them from coming after you, demanding more money, months, or even years later.

Rovner: So this was obviously part of a dispute between the insurance company and the hospital. What became of the second bill, the year-later bill?

Liss: Yeah. After Eloise Reynolds took out a yardstick and went line by line through each charge and she couldn’t find a discrepancy or anything that had changed, she reached out to KFF Health News for help. And she was still skeptical about the bill and didn’t want to pay it. And so when we reached out to the health system, they said, “Actually, you know what? This is a clerical error. She does not owe this money.” And it sort of left her even more frustrated, because as she explained to us, she says, “I think a lot of people would’ve ended up paying this additional amount.”

Rovner: So what’s the takeaway here? What do you do if you suddenly get a bill that comes, what seems, out of nowhere?

Liss: The experts we talked to said Eloise did everything right. She was skeptical. She compared, most importantly, the bills that she was getting from the hospital system against the EOBs that she was getting from her insurance company.

Rovner: The explanation of benefits form.

Liss: That’s right. The explanation of benefits. And she was comparing those two against one another, to help guide her on what she should be doing. And because those were different between the two of them, she was left even more confused. I think folks that we spoke to said, “Yeah, she did the right thing by pushing back and demanding some explanations.”

Rovner: So I guess the ultimate lesson here is, if you can’t get satisfaction, you can always write to us.

Liss: Yeah, I hate to say that in a way, because that’s a hard solution to scale for most folks. But yeah, I mean, I think it points to just how confusing our health care system is. Eloise seemed to be a pretty savvy health care consumer, and she even couldn’t figure it out. And she was pretty tenacious in her pursuit of making phone calls to both the insurance company and the hospital system. And I think when she couldn’t figure that out, and she finally turned to us asking for help.

Rovner: So well, another lesson learned. Samantha Liss, thank you very much for joining us.

Liss: Thanks.

Rovner: Hey, “What the Health?” listeners, you already know that few things in health care are ever simple. So, if you like our show, I recommend you also listen to “Tradeoffs,” a podcast that goes even deeper into our costly, complicated, and often counterintuitive health care system. Hosted by longtime health care journalist and friend Dan Gorenstein, “Tradeoffs” digs into the evidence and research data behind health care policies and tells the stories of real people impacted by decisions made in C-suites, doctors’ offices, and even Congress. Subscribe wherever you listen to your podcasts.

OK, we’re back. It’s time for our extra-credit segment. That’s when we each recommend a story we read this week we think you should read too. As always, don’t worry if you miss it. We will post the links on the podcast page at kffhealthnews.org, and in our show notes on your phone or other mobile device. Sarah, you were the first to choose this week, so you get to go first.

Karlin-Smith: Sure. I looked at a story in the Los Angeles Times, “California Workers Who Cut Countertops Are Dying of an Incurable Disease,” by Emily Alpert Reyes and Cindy Carcamo. Hopefully I didn’t mispronounce her name. They wrote a really fascinating but sad story about people working in an industry where they’re cutting engineered stone countertops for people’s kitchens and so forth. And because of the materials in this engineered product, they’re inhaling particles that is basically giving people at a very young age incurable and deadly lung disease. And it’s an interesting public health story about sort of the lack of protection in place for some of the most vulnerable workers. It seems like this industry is often comprised of immigrant workers. Some who kind of essentially go to … outside a Home Depot, the story suggests, or something like that and kind of get hired for day labor.

So they just don’t have the kind of power to sort of advocate for protections for themselves. And it’s just also an interesting story to think about, as consumers I think people are not always aware of the costs of the products they’re choosing. And how that then translates back into labor, and the health of the people producing it. So, really fascinating, sad piece.

Rovner: Another product that you have to sort of … I remember when they first were having the stories about the dust in microwave popcorn injuring people. Sandhya, why don’t you go next?

Raman: So my extra credit this week is from NPR and it’s by Meg Anderson. And it’s called “1 in 4 Inmate Deaths Happen in the Same Federal Prison. Why?” This is really interesting. It’s an investigation that looks at the deaths of individuals who died either while serving in federal prison or right after. And they looked at some of the Bureau of Prisons data, and it showed that 4,950 people had died in custody over the past decade. But more than a quarter of them were all in one correctional facility in Butner, North Carolina. And the investigation found out that the patients here and nationwide are dying at a higher rate, and the incarcerated folks are not getting care for serious illnesses — or very delayed care, until it’s too late. And the Butner facility has a medical center, but a lot of times the inmates are being transferred there when it was already too late. And then it’s really sad the number of deaths is just increasing. And just, what can be done to alleviate them?

Rovner: It was a really interesting story. Rachel.

Roubein: My extra credit, the headline is “A Decades-Long Drop in Teen Births Is Slowing, and Advocates Worry a Reversal Is Coming,” by Catherine Sweeney from WPLN, in partnership with KFF Health News. And she writes about the national teen birth rate and how it’s declined dramatically over the past three decades. And that, essentially, it’s still dropping, but preliminary data released in June from the CDC shows that that descent may be slowing. And Catherine had talked to doctors and other service providers and advocates, who essentially expressed concern that the full CDC dataset release later this year can show a rise in teen births, particularly in Southern states. And she talked to experts who pointed to several factors here, including the Supreme Court’s decision to overturn Roe v. Wade, intensifying political pushback against sex education programs, and the impact of the pandemic on youth mental health.

Rovner: Yeah. There’ve been so many stories about the decline in teen birth, which seemed mostly attributable to them being able to get contraception. To get teens not to have sex was less successful than getting teens to have safer sex. So we’ll see if that tide is turning. Well, I’m still on the subject of health costs this week. My story is a study from JAMA Internal Medicine that was conducted in part by Shark Tank panelist Mark Cuban, for whom health price transparency has become something of a crusade. This study is of a representative sample of 60 hospitals of different types conducted by researchers from the University of Texas. And it assessed whether the online prices posted for two common procedures, vaginal childbirth and a brain MRI, were the same as the prices given when a consumer called to ask what the price would be. And surprise. Mostly they were not. And often the differences were very large. In fact, to quote from the study, “For vaginal childbirth, there were five hospitals with online prices that were greater than $20,000, but telephone prices of less than $10,000. The survey was done in the summer of 2022, which was a year and a half after hospitals were required to post their prices online.” At some point, you have to wonder if anything is going to work to help patients sort out the prices that they are being charged for their health care. Really eye-opening study.

All right, that is our show for this week. As always, if you enjoy the podcast, you can subscribe wherever you get your podcasts. We’d appreciate it if you left us a review; that helps other people find us, too. Special thanks as always to our amazing engineer, Francis Ying. Also, as always, you can email us your comments or questions. We’re at whatthehealth@kff.org. Or you can still find me at X, @jrovner. Sarah.

Karlin-Smith: I’m @SarahKarlin, or @sarahkarlin-smith.

Rovner: Sandhya.

Raman: @SandhyaWrites

Rovner: Rachel.

Roubein: @rachel_roubein

Rovner: We will be back in your feed next week. Until then, be healthy.

Credits

Francis Ying

Audio producer

Emmarie Huetteman

Editor

To hear all our podcasts, click here.

And subscribe to KFF Health News’ “What the Health?” on Spotify, Apple Podcasts, Pocket Casts, or wherever you listen to podcasts.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

1 year 8 months ago

Courts, COVID-19, Health Care Costs, Health Industry, Insurance, Medicaid, Medicare, Multimedia, Public Health, States, Guns, KFF Health News' 'What The Health?', Legislation, Podcasts, vaccines

KFF Health News' 'What the Health?': Countdown to Shutdown

The Host

Julie Rovner

KFF Health News

Julie Rovner is chief Washington correspondent and host of KFF Health News’ weekly health policy news podcast, “What the Health?” A noted expert on health policy issues, Julie is the author of the critically praised reference book “Health Care Politics and Policy A to Z,” now in its third edition.

Health and other federal programs are at risk of shutting down, at least temporarily, as Congress races toward the Oct. 1 start of the fiscal year without having passed any of its 12 annual appropriations bills. A small band of conservative House Republicans are refusing to approve spending bills unless domestic spending is cut beyond levels agreed to in May.

Meanwhile, former President Donald Trump roils the GOP presidential primary field by vowing to please both sides in the divisive abortion debate.

This week’s panelists are Julie Rovner of KFF Health News, Alice Miranda Ollstein of Politico, Rachel Cohrs of Stat News, and Tami Luhby of CNN.

Panelists

Alice Miranda Ollstein

Politico

Rachel Cohrs

Stat News

Tami Luhby

CNN

Among the takeaways from this week’s episode:

- The odds of a government shutdown over spending levels are rising. While entitlement programs like Medicare would be largely spared, past shutdowns have shown that closing the federal government hobbles things Americans rely on, like food safety inspections and air travel.

- In Congress, the discord isn’t limited to spending bills. A House bill to increase price transparency in health care melted down before a vote this week, demonstrating again how hard it is to take on the hospital industry. Legislation on how pharmacy benefit managers operate is also in disarray, though its projected government savings means it could resurface as part of a spending deal before the end of the year.

- On the Senate side, legislation intended to strengthen primary care is teetering under Bernie Sanders’ stewardship — in large part over questions about how to pay for it. Also, this week Democrats broke Alabama Republican Sen. Tommy Tuberville’s abortion-related blockade of military promotions (kind of), going around him procedurally to confirm the new chair of the Joint Chiefs of Staff.

- And some Republicans are breaking with abortion opponents and mobilizing in support of legislation to renew the United States President’s Emergency Plan for AIDS Relief — including the former president who spearheaded the program, George W. Bush. Meanwhile, polling shows President Joe Biden is struggling to claim credit for the new Medicare drug negotiation program.

- And speaking of past presidents, former President Donald Trump gave NBC an interview over the weekend in which he offered a muddled stance on abortion. Vowing to settle the long, inflamed debate over the procedure — among other things — Trump’s comments were strikingly general election-focused for someone who has yet to win his party’s nomination.

Plus, for “extra credit,” the panelists suggest health policy stories they read this week that they think you should read, too:

Julie Rovner: The Washington Post’s “Inside the Gold Rush to Sell Cheaper Imitations of Ozempic,” by Daniel Gilbert.

Alice Miranda Ollstein: Politico’s “The Anti-Vaccine Movement Is on the Rise. The White House Is at a Loss Over What to Do About It,” by Adam Cancryn.

Rachel Cohrs: KFF Health News’ “Save Billions or Stick With Humira? Drug Brokers Steer Americans to the Costly Choice,” by Arthur Allen.

Tami Luhby: CNN’s “Supply and Insurance Issues Snarl Fall Covid-19 Vaccine Campaign for Some,” by Brenda Goodman.

Also mentioned in this week’s episode:

- The AP’s “Biden’s Medicare Price Negotiation Is Broadly Popular. But He’s Not Getting Much Credit,” by Seung Min Kim and Linley Sanders.

- Roll Call’s “Sanders, Marshall Reach Deal on Health Programs, but Challenges Remain,” by Jessie Hellmann and Lauren Clason.

CLICK TO EXPAND THE TRANSCRIPT

Transcript: Countdown to Shutdown

[Editor’s note: This transcript was generated using both transcription software and a human’s light touch. It has been edited for style and clarity.]

Julie Rovner: Hello and welcome back to “What the Health?” I’m Julie Rovner, chief Washington correspondent for KFF Health News. And I’m joined by some of the best and smartest health reporters in Washington. We’re taping this week on Thursday, Sept. 21, at 9 a.m. because, well, lots of news this week. And as always, news happens fast, and things might well have changed by the time you hear this. So here we go. We are joined today via video conference by Tami Luhby of CNN.

Tami Luhby: Good morning.

Rovner: Rachel Cohrs of Stat News.

Rachel Cohrs: Hi, everybody.

Rovner: And Alice Miranda Ollstein of Politico.

Alice Miranda Ollstein: Hello.

Rovner: Let’s get to some of that news. We will begin on Capitol Hill, where I might make a T-shirt from this tweet from Wednesday from longtime congressional reporter Jake Sherman: “I feel like this is not the orderly appropriations process that was promised after the debt ceiling deal passed.” For those of you who might’ve forgotten, many moons ago, actually it was May, Congress managed to avoid defaulting on the national debt, and as part of that debt ceiling deal agreed to a small reduction in annual domestic spending for the fiscal year that starts Oct. 1 (as in nine days from now). But some of the more conservative Republicans in the House want those cuts to go deeper, much deeper, in fact. And now they’re refusing to either vote for spending bills approved by the Republican-led appropriations committee or even for a short-term spending bill that would keep the government open after this year’s funding runs out. So how likely is a shutdown at this point? I would hazard a guess to say pretty likely. And anybody disagree with that?

Ollstein: It’s more likely than it was a week or two ago, for sure. The fact that we’re at the point where the House passing something that they know is dead on arrival in the Senate would be considered a victory for them. And so, if that’s the case, you really have to wonder what the end game is.

Rovner: Yeah, I mean it was notable, I think, that the House couldn’t even pass the rule for the Defense Appropriations Bill, which is the most Republican-backed spending bill, and the House couldn’t get that done. So I mean it does not bode well for the fate of some of these domestic programs that Republicans would, as I say, like to cut a lot deeper. Right?

Cohrs: Democrats are happy, I think, to watch Republicans flail for a while. I think we saw this during the speaker votes. Obviously, a CR [continuing resolution] could pass with wide bipartisan support, but I think there’s a political interest for Democrats going into an election year next year to lean into the idea of the House Republican chaos and blaming them for a shutdown. So I wouldn’t be too optimistic about Democrats billing them out anytime soon.

Rovner: But, bottom line, of course, is that a shutdown is not great for Democrats who support things that the government does. I mean, Tami, you’re watching, what does happen if there’s a shutdown? Not everything shuts down and not all the money stops flowing.

Luhby: No, and the important thing, unlike in the debt ceiling, potentially, was that Social Security will continue, Medicare will continue, but it’ll be very bothersome to a lot of people. There’ll be important things that … potentially chaos at airlines and food safety inspectors. I mean some of them are sometimes considered essential workers, but there’s still issues there. So people will be mad because they can’t go to their national parks potentially. I mean it’s different every time, so it’s a little hard to say exactly what the effects will be and we’ll see also whether this will be a full government shutdown, which will be much more serious than a partial government shutdown, although at this point it doesn’t look like they’re going to get any of the appropriation bills through.